Featured

Table of Contents

Consumers that enlist in the AMP program are not qualified for time payment plan. Internet Energy Metering (NEM), Straight Accessibility (DA), and master metered customers are not currently eligible. For consumers intending on moving within the following 60 days, please apply to AMP after you've established service at your brand-new move-in address.

One essential aspect of financial obligation mercy associates to tax obligation status. The general regulation for the Internal revenue service is that forgiven financial obligation revenue is taxable.

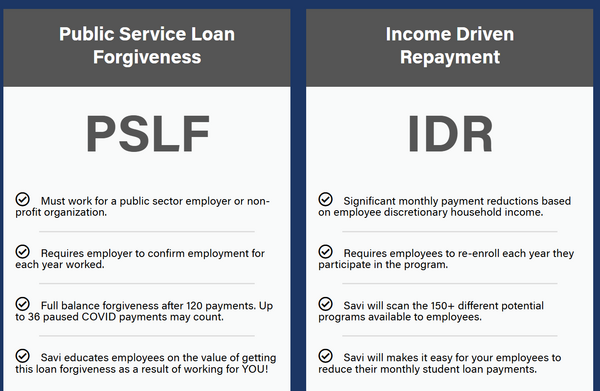

The PSLF program is for customers who are employed permanent in certifying civil service jobs. You would need to be eligible when you have made 120 certifying settlements under a certifying settlement plan while helping a qualifying company. As soon as you have actually satisfied this demand, the equilibrium on your Straight Fundings is forgiven.

Some Known Incorrect Statements About Understanding Various Relief Programs You Need to Know About

This is to urge educators to serve in locations where they are most needed. IDR plans to readjust your monthly pupil finance payment amount based upon revenue and family dimension. Any exceptional balance is forgiven after 20 or 25 years of qualified repayments, depending on the specific selected actual strategy.

The CARES Act suspended funding repayments and established rate of interest rates at 0% for qualified federal student financings. Private trainee lendings can not be forgiven under the government financing forgiveness programs since they are released by private lending institutions and do not lug the backing of the federal government.

Paying off might involve a reduced passion rate or more workable monthly payments. Excellent credit report is required, so not all consumers may certify.

The smart Trick of Tools Available for Your Debt Relief Journey That Nobody is Talking About

Some personal loan providers offer case-by-case hardship programs. These include momentarily making interest-only settlements, temporarily minimizing payments listed below the agreement rate, and also other types of lodgings. Obtain against those assets, like money value from a life insurance plan, or take financings from family members and friends. Such alleviation is, nonetheless, short-term in nature and includes its very own collection of threats that should be carefully evaluated.

Some of the debts forgiven, specifically acquired from financial debt settlement, likewise adversely effect credit ratings. Often, the argument regarding debt mercy concentrates on its long-lasting effects.

Forgiveness of big amounts of financial obligation can have substantial financial implications. It can include in the nationwide financial debt or demand reallocation of funds from other programs. Policymakers, therefore, need to balance the prompt direct benefits to some individuals with the general financial influence. There are arguments that financial obligation forgiveness is not reasonable to those that currently repaid their finances or followed less costly paths of education and learning.

Understand that your lendings might be purely government, purely exclusive, or a combination of both, and this will certainly factor into your selections. Forgiveness or settlement programs can easily straighten with your long-lasting financial goals, whether you're buying a home or planning for retirement. Know just how the various kinds of debt relief might influence your credit history and, later, future borrowing capacity.

9 Easy Facts About Post-Bankruptcy Help Including Follow-Up Services Shown

Given the possible tax implications, consulting a tax specialist is suggested. Financial obligation forgiveness programs can be a genuine lifesaver, however they're not the only means to take on installing debt. These plans change your federal trainee car loan payments based on your income and family members size. They can decrease your regular monthly settlements now and might forgive your continuing to be debt later on.

You can use monetary apps to view your spending and set cash goals. 2 ways to repay debt are the Snowball and Avalanche approaches. Both aid you focus on one debt each time: Repay your tiniest financial obligations first. Pay off financial debts with the highest passion prices.

Prior to deciding, assume about your very own cash situation and future strategies. This way, you can make choices that will help your financial resources in the long run. Canceled Financial Obligations, Foreclosures, Foreclosures, and Abandonments (for Individuals).

Unlike financial debt combination, which combines numerous financial obligations right into a single financing, or a debt monitoring plan, which reorganizes your repayment terms, debt forgiveness directly reduces the major equilibrium owed. The remaining equilibrium is then forgiven. You may choose to discuss a settlement on your own or enlist the help of a debt settlement firm or a knowledgeable financial debt assistance lawyer.

Not simply any person can get credit history card financial obligation forgiveness. You typically need to be in dire economic straits for lending institutions to also consider it. In specific, financial institutions check out various factors when thinking about debt mercy, including your income, properties, other financial obligations, ability to pay, and determination to coordinate.

Some Known Incorrect Statements About What's Ahead for Bankruptcy Counseling and Debtor Options

In some situations, you may be able to settle your financial obligation situation without resorting to insolvency. Prioritize crucial expenses to boost your financial scenario and make space for financial debt repayments.

Table of Contents

Latest Posts

3 Simple Techniques For Accessing Support for Anyone's Debt Relief Journey

How to Get Started with Your Debt Forgiveness Journey Fundamentals Explained

Getting The Compliance Aspects Related to A Season of Gratitude: How APFSC Helps Families Thrive : APFSC To Work

More

Latest Posts

3 Simple Techniques For Accessing Support for Anyone's Debt Relief Journey

How to Get Started with Your Debt Forgiveness Journey Fundamentals Explained

Getting The Compliance Aspects Related to A Season of Gratitude: How APFSC Helps Families Thrive : APFSC To Work